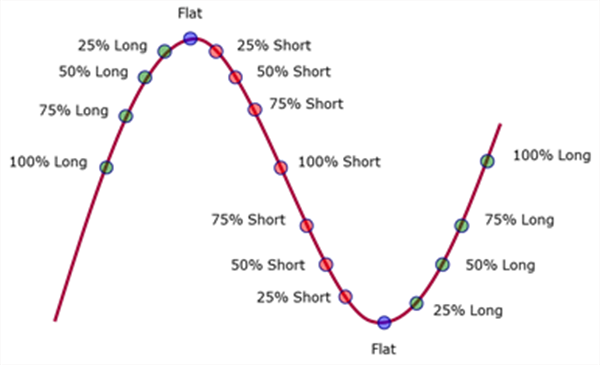

Binance on Twitter: "#Binance Futures traders are currently Long $BTC/USDT overall on the daily time frame. "Top traders" are defined as the top 20% of traders by margin balance. Trade on #BinanceFutures

Payoff for long futures Figure shows that investor makes a profit in... | Download Scientific Diagram

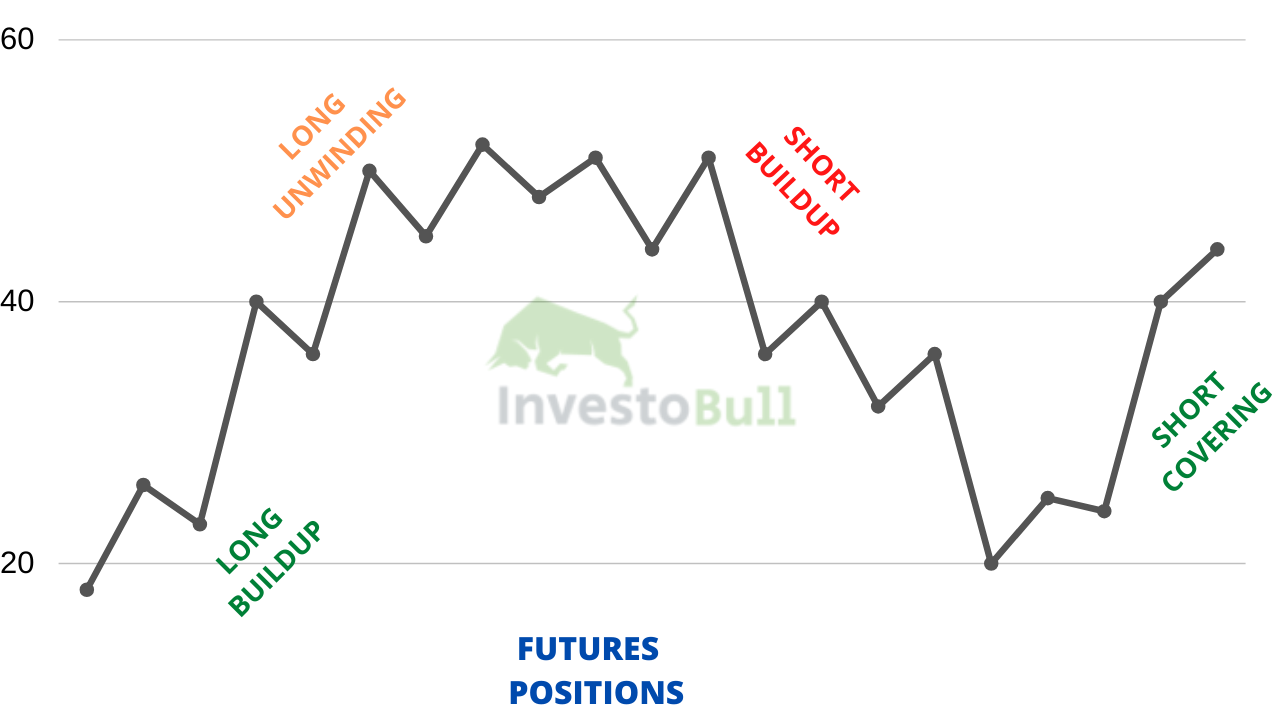

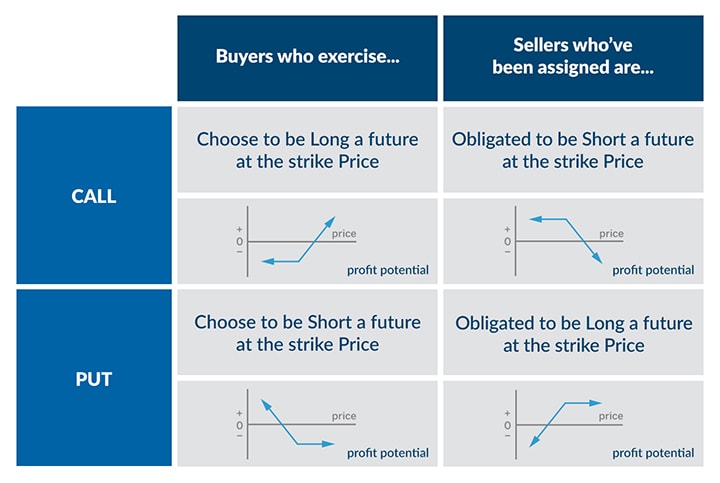

Long Short Options Terminology: What every trader should know aboutOptions Trading: Options, Futures, Derivatives & Commodity Trading

Twitter 上的Binance:"#BinanceFutures $BTC/USDT Longs vs Shorts (Daily) Accounts Long: 50.07% Accounts Short: 49.93% Long/Short Ratio: 1 Check out more #Binance Futures trading data here: https://t.co/1p8JYZJZP9 https://t.co/sVtby3e8x2" / Twitter

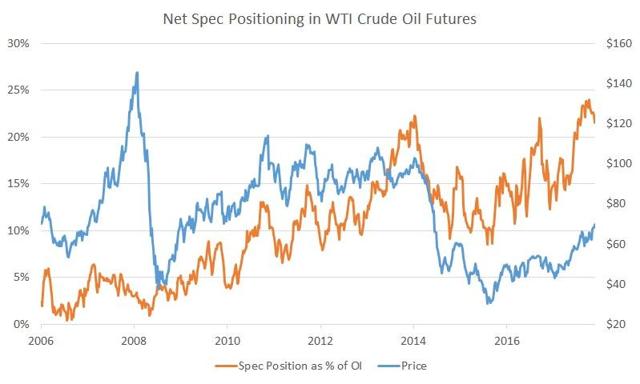

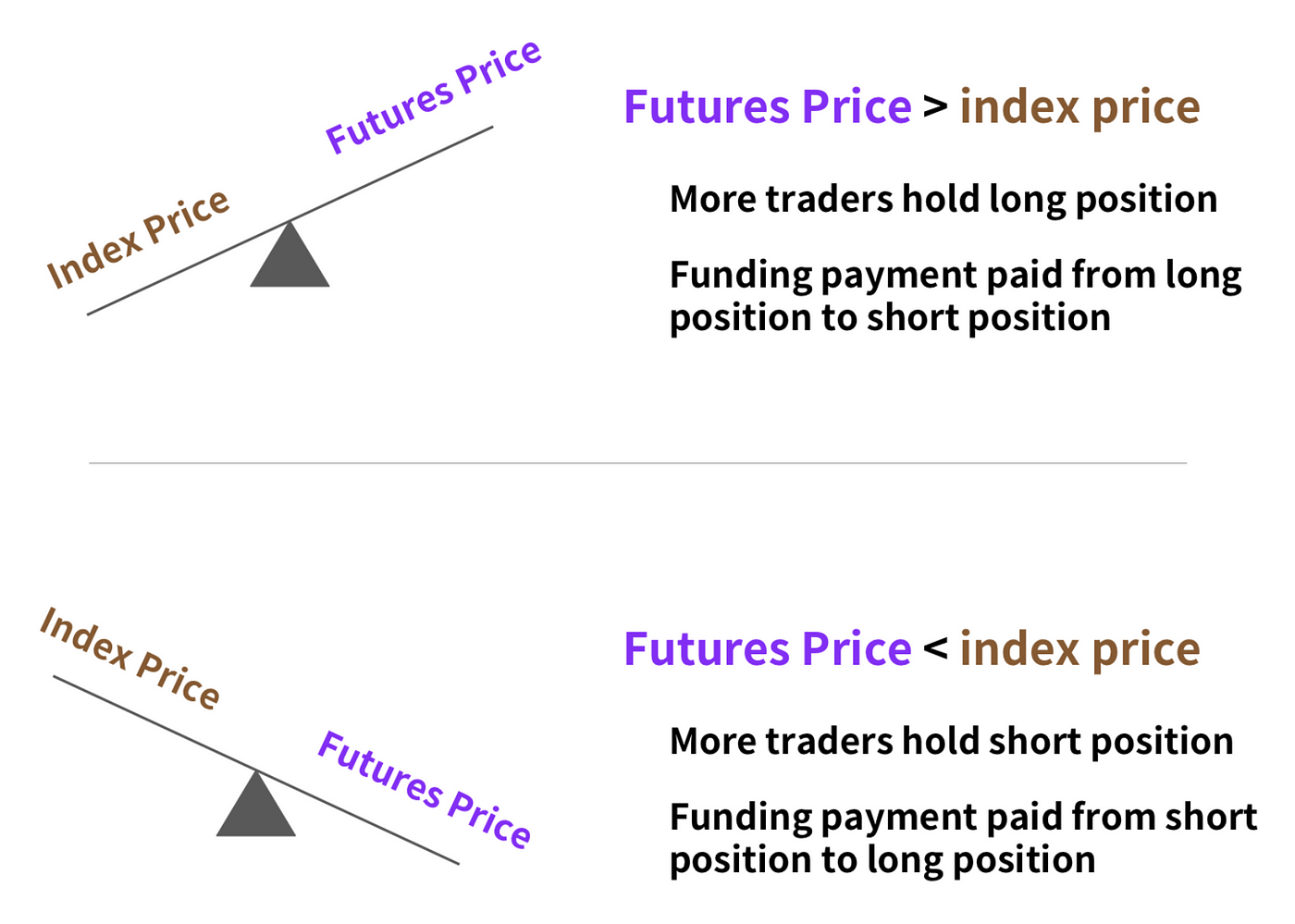

Spot-Futures Arbitrage Strategy. Earn steady income with extremely low… | by Mario liu | Coinmonks | Medium